Discovering the Best Indicator for Pocket Option: A Comprehensive Guide

In the world of online trading, finding the best indicator for Pocket Option can significantly improve your trading strategy and decision-making process. As traders, we all seek tools that offer us an edge in the volatile financial markets, and indicators are essential in simplifying data analysis. The best indicator for pocket option best indicator for pocket option assists traders in identifying trends, potential entry and exit points, and overall market sentiment.

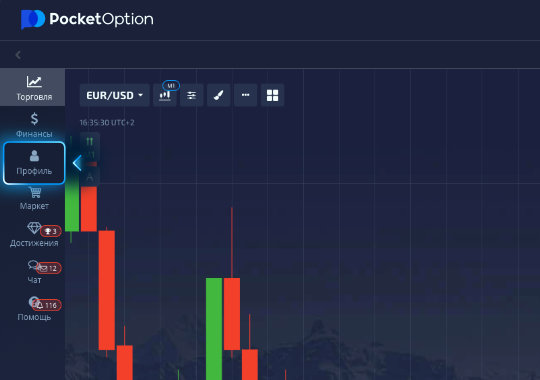

Understanding Pocket Option

Pocket Option is a popular trading platform that allows users to trade a variety of financial instruments such as forex, cryptocurrencies, and commodities. One of its standout features is the availability of a multitude of indicators that can help traders optimize their trading strategies. Each indicator serves a unique purpose, providing insights into market conditions, either through price action, volume, or other relevant statistics.

Types of Indicators

When it comes to trading on Pocket Option, several types of indicators can be used, each catering to different trading styles. Below, we will discuss some of the best indicators widely favored by traders on this platform.

1. Moving Averages

Moving Averages (MAs) are one of the most commonly used indicators in financial trading. They smooth out price data by creating a constantly updated average price. This is particularly useful for identifying trends. Traders can use different types of moving averages, such as Simple Moving Average (SMA) and Exponential Moving Average (EMA), to filter out market noise and determine potential buy or sell signals.

2. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent standard deviations from the moving average. This indicator is instrumental in determining overbought or oversold conditions. When the price approaches the upper band, it often indicates that an asset may be overbought, while a price near the lower band may signify an oversold market.

3. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is primarily used to identify overbought or oversold conditions in a market. An RSI above 70 typically indicates an overbought condition, while an RSI below 30 suggests an oversold condition.

4. MACD (Moving Average Convergence Divergence)

The MACD is another popular indicator that helps traders understand market momentum. It consists of two moving averages and a histogram representing the distance between the two. The crossing of the MACD line and signal line is a popular trading signal for many traders on Pocket Option.

Combining Indicators for Better Trading

While individual indicators provide valuable information, combining multiple indicators can help create a more robust trading strategy. For instance, many traders use RSI in conjunction with Moving Averages to identify the market trend’s strength alongside potential entry and exit points. The key to successful trading is to develop a strategy that integrates various indicators without over-complicating the analysis.

Strategies for Effective Trading on Pocket Option

To leverage the power of the best indicators effectively, traders on Pocket Option should consider the following strategies:

1. Backtesting

Before deploying any strategy in live trading, it is crucial to backtest it against historical data. This allows traders to understand how their chosen indicators would have performed in past market conditions, providing insights into potential success or failure.

2. Risk Management

Good risk management practices can help traders protect their capital. Utilizing stop-loss orders and maintaining a consistent risk-reward ratio are essential components of a solid trading strategy. Indicators can help establish these orders based on market volatility and price movement.

3. Continuous Education

The financial markets are ever-evolving. Traders should commit to continuous education, whether through online courses, webinars, or reading the latest trading literature. This ongoing process helps traders stay informed about new indicators, strategies, and market trends.

Conclusion

In conclusion, the best indicator for Pocket Option varies from trader to trader, depending on individual trading styles and preferences. However, understanding and utilizing the popular indicators mentioned in this article can significantly enhance trading performance. Remember, the key to successful trading is not just about using indicators but also about developing a comprehensive strategy that includes backtesting, risk management, and continuous learning. By doing so, traders can navigate the vibrant world of online trading with greater confidence and success.