Product costs are the costs of making a product, such as an automobile; the cost of making and serving a meal in a restaurant; or the cost of teaching a class in a university. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

What are the benefits of calculating manufacturing cost?

However, as we noted earlier, managerial accounting information is tailored to meet the needs of the users and need not follow U.S. In a manufacturing company, overhead is generally called manufacturing overhead. (You may also see other names for manufacturing overhead, such as factory overhead, factory indirect costs, or factory burden.) Service companies use service overhead, and construction companies use construction overhead. Any of these companies may just use the term overhead rather than specifying it as manufacturing overhead, service overhead, or construction overhead. Overhead is part of making the good or providing the service, whereas selling costs result from sales activity and administrative costs result from running the business. Direct labor costs include the labor costs of all employees actually working on materials to convert them into finished goods.

Keep Your Business Afloat With These Budgeting Methods

Each table is unique and built to customer specifications for use in homes (coffee tables and dining room tables) and offices (boardroom and meeting room tables). The sales price of each table varies significantly, from $1,000 to more than $30,000. Figure 2.3.1 shows examples of production activities at Custom Furniture Company for each of the three categories. Nonmanufacturing, also known as “period” costs, consists of selling and administrative expenses.

Manufacturing Overhead (Explanation Part

- Direct materials should be distinguished from indirect materials (part of overhead costs), about which we will talk later.

- In his experience, the most common challenges are a lack of accurate data and the complexity of costing methods.

- Here’s an interesting case study on how manufacturing cost analysis helped a steel manufacturing company save costs.

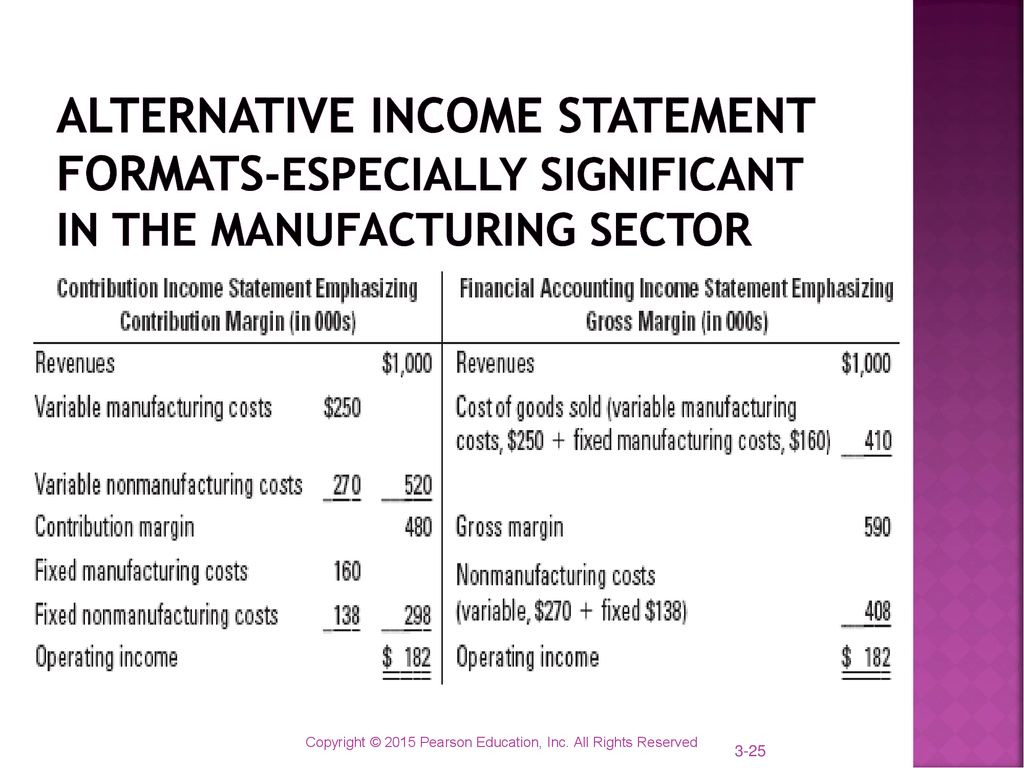

- However, if management wants to determine the profitability of a specific product or customer, it is necessary to allocate or assign nonmanufacturing costs to the products and/or customers outside of the financial statements.

- As the manufacturing process involves raw materials and finished goods, all of these are considered assets.

The relevance of costing to manufacturing companies is highly important to running an efficient and successful business. Identifying, separating and apportioning cost data provides management and outside decision makers (investors) valuable information on the company’s profitability and cost control systems. For accounting purposes, nonmanufacturing costs are expensed periodically (typically in the period they are incurred).

Resources

However, for management objectives, managers frequently require the assignment of nonmanufacturing costs to goods. This is especially true for specific product-related commissions and promotions. Non-manufacturing costs refer to expenses that are not directly tied to the production of goods or services. These costs encompass a variety of expenses such as selling, administrative, and research and development costs, which support the overall operations of a business but do not contribute to the creation of products. Understanding non-manufacturing costs is essential for effective budgeting and financial planning as they impact overall profitability and can influence pricing strategies. Figure 1.4 shows examples of production activities at Custom Furniture Company for each of the three categories (we continue using this company as an example in Chapter 2).

1. Direct materials as a type of manufacturing costs

These indirect costs, also called factory or manufacturing overheads, include costs related to property tax, insurance, maintenance, and other indirect operations that support the production process. Indirect manufacturing costs include all other expenses incurred in manufacturing a product except direct expenses. Period expenses are closely related to periods of time rather than units of products.

The second part of the necessary entry will be a credit to a liability account. The general guidelines and principles, standards and detailed rules, plus industry practices that exist for financial reporting.

For instance, managers of consumer goods companies such as Procter & Gamble and Anheuser-Busch prefer to allocate the high expense of advertising to a certain product. For instance, Ford Motor Company has petty cash: what it is how it’s used and accounted for examples reduced the price of F-150 Lightning, its electric car, by $10,000. The company has been able to do so by consistently working on improving the efficiency of production and lowering manufacturing costs.